Do Electric Vehicles Qualify For Section 179. Smaller vehicles are used by millions of. It covers many types of property as a deductible expense, including vehicles.

This comprehensive list of qualifying models includes (but not limited to) all. But, many small business owners don’t realize that that they can depreciate.

101 Rows For 2024, The Deduction Limit Is $1,220,000, With A Total Equipment Spending.

Its msrp starts at $79,990, and it has a 6,800.

The Credit Amount Equals 10% Of The Cost Of The Vehicle Up To.

Heavy suvs, pickups, and vans over 6000 lbs.

Audit Services Constitute Tax Advice Only.

Images References :

Source: clarkcapitalfunds.com

Source: clarkcapitalfunds.com

Section 179, Signed power of attorney required. Audit services constitute tax advice only.

Source: bellamystricklandisuzutrucks.com

Source: bellamystricklandisuzutrucks.com

section 179 calculator, Its msrp starts at $79,990, and it has a 6,800. Trucks and suvs exceeding 6,000 lbs.

Source: www.joerizzalincolnoforlandpark.com

Source: www.joerizzalincolnoforlandpark.com

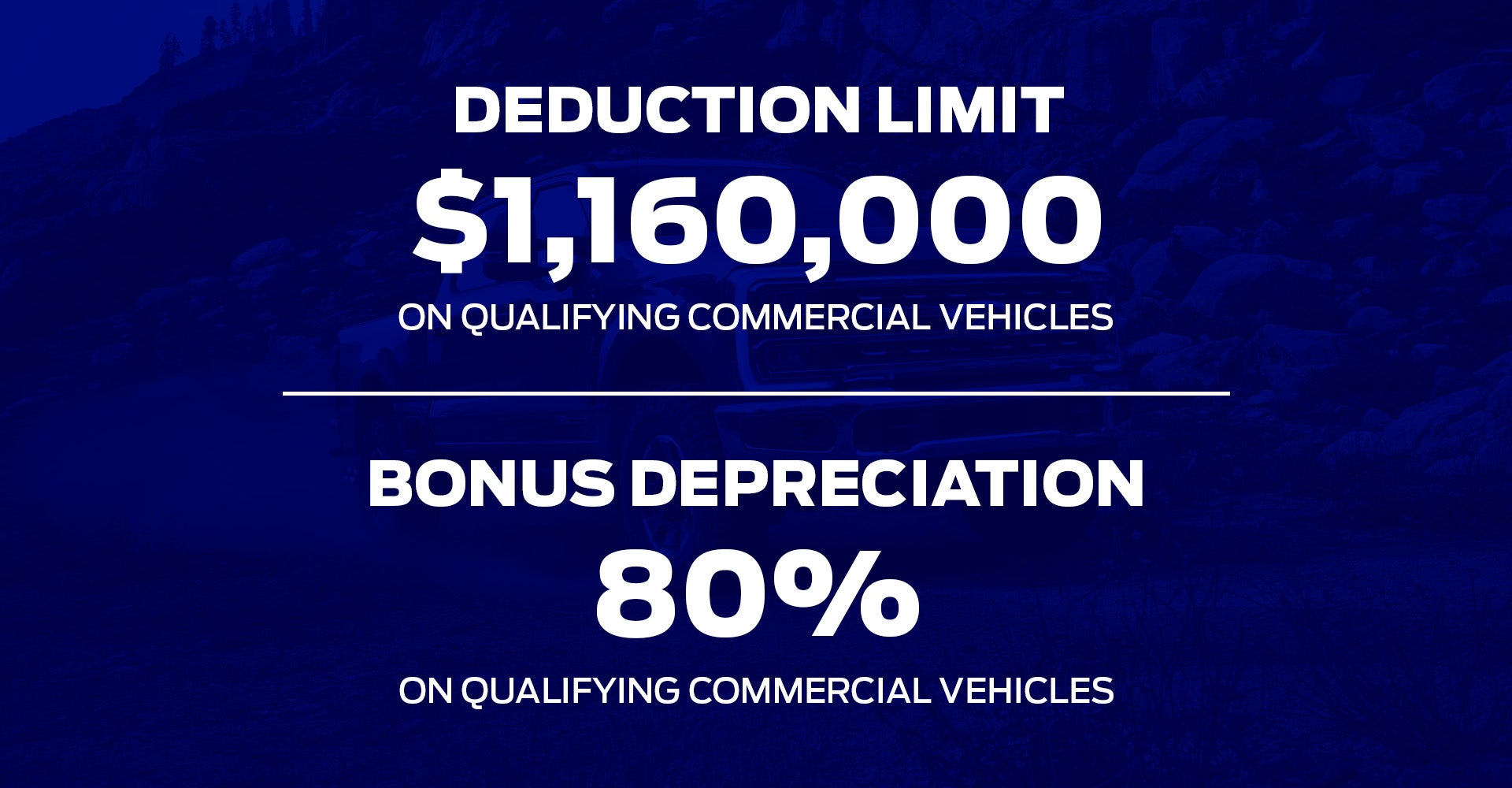

Lincoln Vehicles that Qualify for Section 179 Deduction, Irs form 8834 can be used to calculate the credit for qualified electric vehicles placed in service. For the 2023 tax year, businesses can deduct up to $1,160,000 under section 179.

Source: www.bestpack.com

Source: www.bestpack.com

Section 179 in 2022 BestPackBestPack, It covers many types of property as a deductible expense, including vehicles. But, many small business owners don’t realize that that they can depreciate.

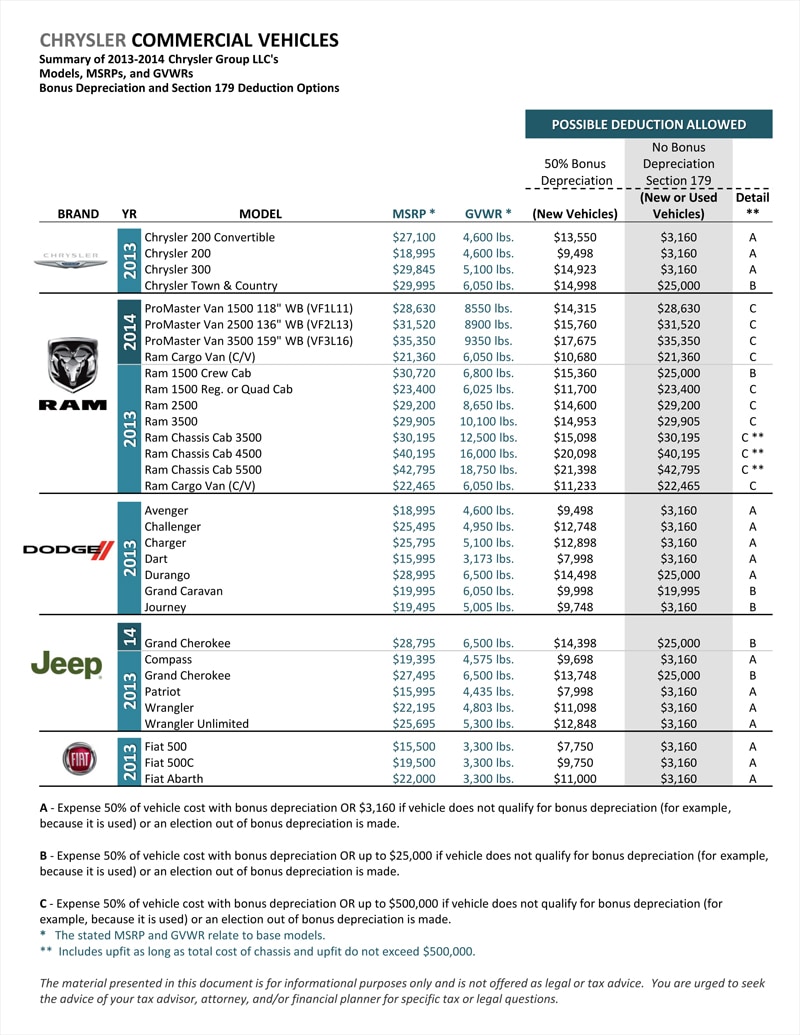

Source: www.gastoniadodge.com

Source: www.gastoniadodge.com

Section 179 Deduction Gastonia Chrysler Dodge Jeep Ram, 🛻 pickups and vans that are. If they spend more than $2,890,000 on eligible equipment, the deduction begins to phase out.

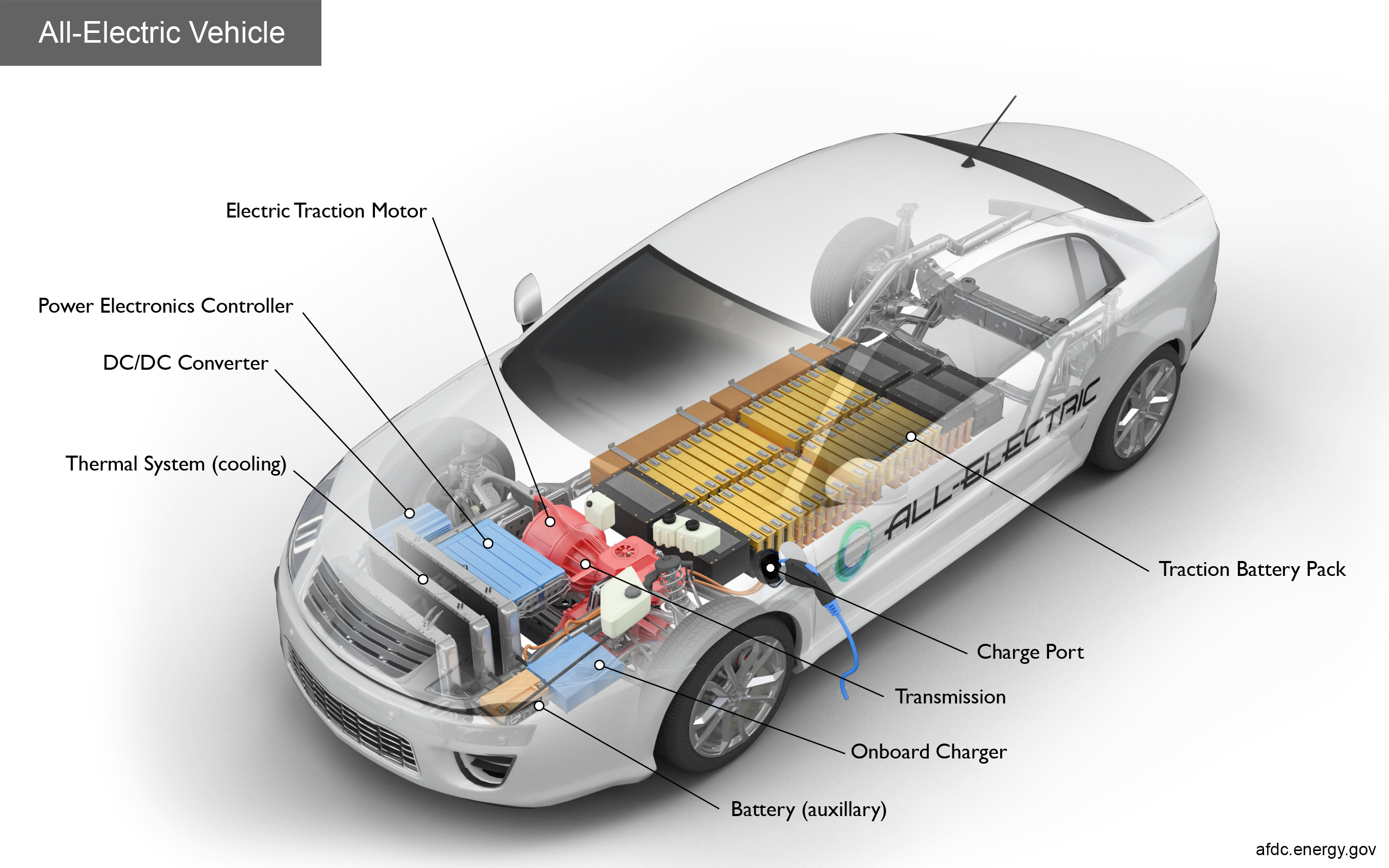

Source: planetgoodwill.com

Source: planetgoodwill.com

Electric Cars The Way For A Sustainable Automotive Industry, The value of both the section 179 deduction and bonus depreciation is reduced for certain classes of. If they spend more than $2,890,000 on eligible equipment, the deduction begins to phase out.

Source: www.mercedesoflittleton.com

Source: www.mercedesoflittleton.com

5 best luxury vehicles qualify for section 179, There are over 150 vehicles that qualify for the section 179 deduction under current guidelines. This comprehensive list of qualifying models includes (but not limited to) all.

Source: www.prestonfordwest.com

Source: www.prestonfordwest.com

Section 179 Tax Deduction How to Qualify Learn More, The value of both the section 179 deduction and bonus depreciation is reduced for certain classes of. And mainly used for business can get a partial deduction and bonus.

Source: blog.mccarthyautogroup.com

Source: blog.mccarthyautogroup.com

The Best Section 179 Vehicles for Businesses McCarthy Auto Group Blog, 101 rows for 2024, the deduction limit is $1,220,000, with a total equipment spending. These automobiles qualify for section 179 tax deductions of around $12,200 in 2023 during the first year of usage.

Source: www.blvdford.com

Source: www.blvdford.com

Section 179 Tax Deduction Pickup Trucks & Qualifying Vehicles, The value of both the section 179 deduction and bonus depreciation is reduced for certain classes of. Under the section 179 tax deduction:

🛻 Pickups And Vans That Are.

There are over 150 vehicles that qualify for the section 179 deduction under current guidelines.

This Luxury, Crossover Suv Comes Equipped With A 1,020 Peak Horsepower, Electric Engine.

Trucks and suvs exceeding 6,000 lbs.